Multiple Income Streams? Now You Can Track Them Independently

Updated on November 1, 2025 | 3 min. read

Use invoice income categorization to assess how each of your income categories is performing, so you can make more informed decisions for your business.

Imagine you are a salon owner planning on expanding your hair salon. You have limited space, and you aren’t sure whether to add another chair or add more space for hair care and other product sales.

So, what do you do? Let the data decide! Take a look at your income statement to see which income category generates the most revenue. With a quick glance, you see that service sales vastly outpace product sales. Bingo. Expanding your team and adding another chair is the way to go.

You can then decide to expand your product line because product sales are easily outpacing service sales.

When you can quickly and accurately assess how each of your income categories is performing and adding to your bottom line, you can make more informed decisions for your business.

To help with that, we’ve improved our feature set to allow customers to easily categorize their invoice income. It gives you and your accountant more control over your income accounts so you can refer to them when you need more detailed information on revenue.

What Is an Income Statement?

An Income Statement (also called a Profit and Loss report) is a snapshot of your organization’s financial performance. It shows your revenues, expenses, and net income over a period of time. With the correct details, the income statement can be a valuable tool for your business by providing insights into what areas you can improve and where your business excels.

An Income Statement shows your organization’s:

- Revenue from selling products or services

- Expenses to generate revenue and manage your business

- Net income (or profit) that remains after your expenses

What Are the Benefits of Multiple Income Categories?

The more complex your business, the more important it is to add multiple categories to your Income Statement.

If your organization has many products and services or multiple locations, your reporting should be more granular, with different income categories.

For example, A Breath of Fresh Hair is a salon. Its Income Accounts might be:

- Product sales

- Services sales

The Write Stuff, by contrast, sells one thing—copywriting services. They are just fine with the default Income Category and don’t need to break down their income into more detail.

How Can You Edit Your Income Accounts?

You can add income accounts in FreshBooks through your Chart of Accounts, which is available on Plus, Premium, and Select plans. If you’re not on one of these plans but want to customize your Chart of Accounts, you can easily and quickly upgrade your plan.

Below, you will find steps on how to add an income account.

To Turn On Advanced Accounting

- Log into your FreshBooks account

- Click on Settings in the left navigation

- Click on Accounting under Advanced Preferences

- Toggle on the Turn on/off Advanced Accounting toggle

To Add an Income Account

- Click on Accounting in the left navigation. Then click on Chart of Accounts underneath.

- Click on More Actions and add New Account.

- Select Account Type and Account Subtype.

- Enter an Account Name and edit the Account Number if desired. You can also include a description to clarify what you will use this account for.

*Owners don’t need to turn on Advanced Accounting to categorize their items and services in custom Income Accounts. Their accountants create a custom income account, and the owner can then categorize their item/service in that income account.

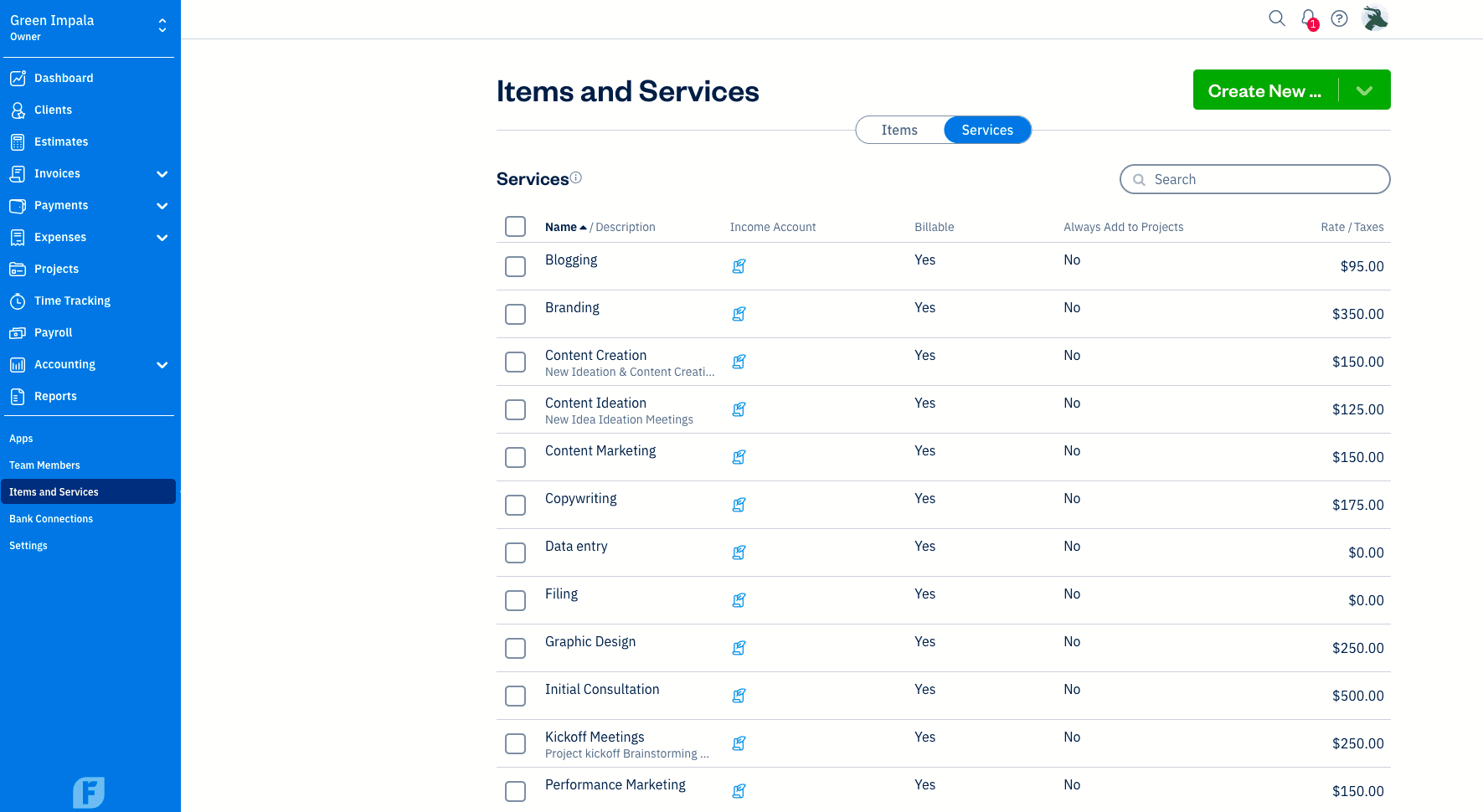

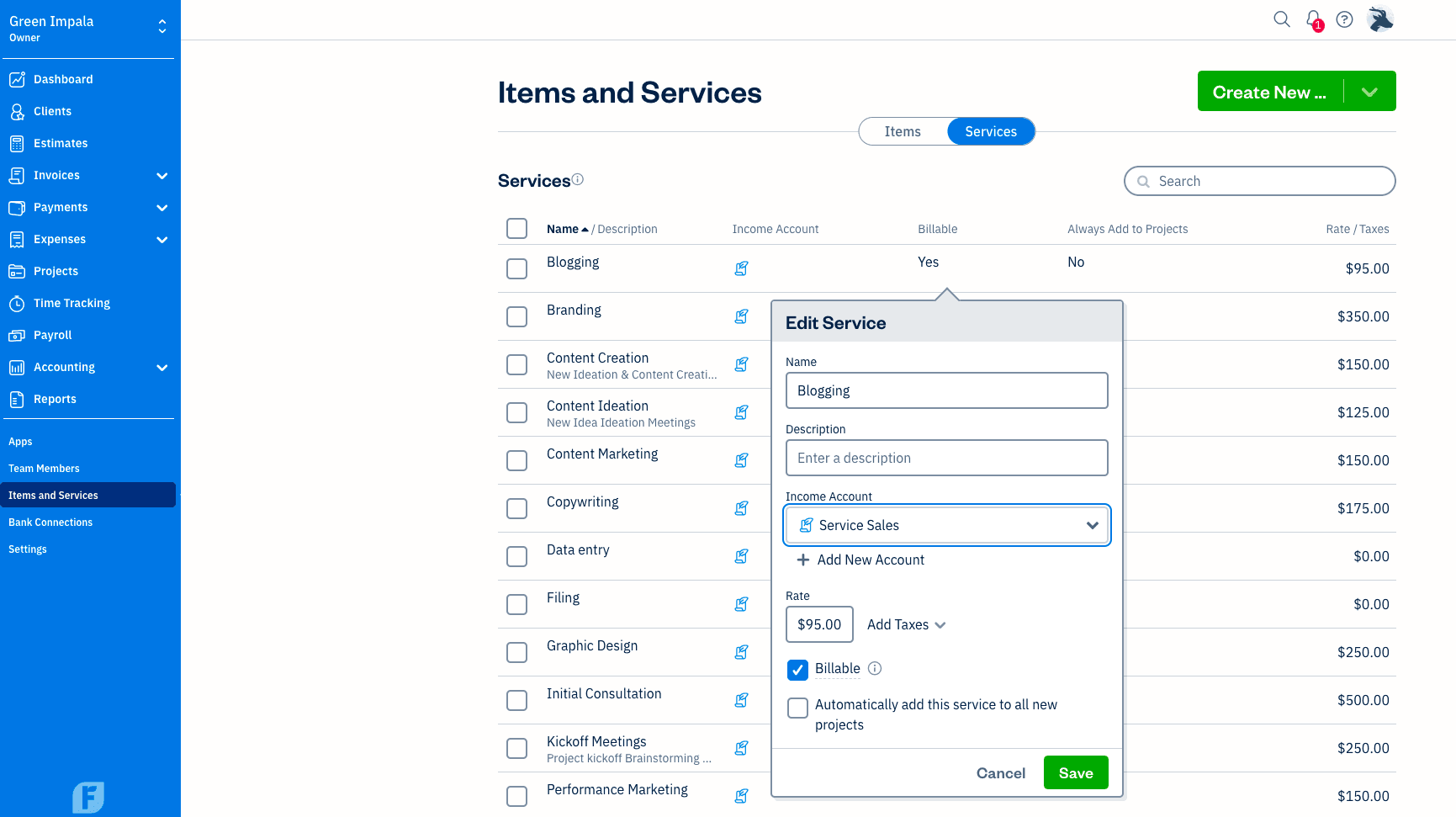

To Assign an Item or Service to an Income Account

To assign an item to an Income Account:

- Go to Items & Services

- Click on an existing item or service

- Choose the Income Account that’s applicable

Do You Have to Add Multiple Income Categories?

Nope, you don’t! You may find the pre-populated default income category is all you need for your specific business, which is fantastic!

However, as your business expands or changes, you may need more flexibility in how you report your income. You or your accountant may want to add income categories to report how well each aspect of your business is performing so you always know what’s the most profitable.

If You Need Help, FreshBooks Is Here

If you have any questions about this feature, don’t hesitate to contact our Support team. We’re here to help!